Robotic Process Automation in accounting has developed strong and consistent growth in recent years. RPA for accounting software lets teams automate payables to relieve staff from manual, repetitive, and error-prone work and ensure suppliers are paid on time. However, there are several other big benefits for businesses too, including regulatory compliance, scalability, and powerful insights into the accounting process.

This article will look at AP automation and explore important elements like market size, growth potential, benefits, challenges, trends, use cases, and case studies.

Accounts Payable Automation

Market size

The RPA for accounting market size in 2023 stands at around $3 billion. Some business analysts predict the industry to have a compound annual growth rate of just below 40%, which suggests the market size in 2032 will stand at a staggering $66 billion.

However, other analysts suggest a far more conservative CAGR of 10% and a future market size of around $6.7 billion by 2032. This discrepancy can be understood as the difference between software sales and general AP automation services.

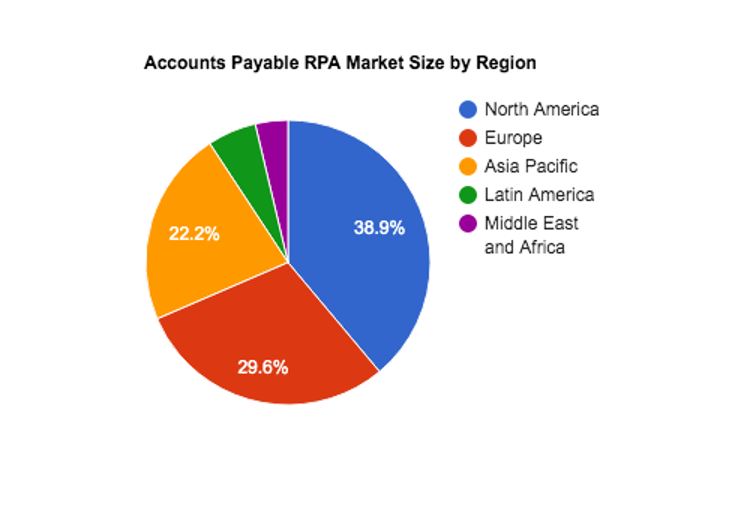

The EU and North America are the biggest adopters of accounts payable automation tools, with Asia Pacific (APAC) not too far behind in third place. Indeed, the APAC market has a current CAGR of around 26%, which makes it the fastest-growing accounting process automation region.

Factors influencing RPA for

accounting growth

Accounting RPA software is on the rise. There are numerous causal factors at play here, including a general need for digitization across the accounting sector. Let’s take a look at some of these drivers of accounting process automation.

#1. The growing sophistication of RPA software

One of the biggest reasons that firms automate payables is because the technology has reached a high level of both sophistication and user-friendliness. Automated bots have existed for a very long time. However, using them for accounts payable invoice automation and similar purposes used to require coding expertise and a considerable amount of maintenance.

RPA and enterprise software test automation tools, like ZAPTEST, fuse different technologies together, such as drag-and-drop interfaces and Optical Character Recognition (OCR) tools. These features mean accounting teams can overcome traditional RPA limitations, such as decision-making and an inability to use unstructured data.

In short, one reason we see more accounts payable process automation these days is that RPA’s value proposition is very strong.

#2. Cloud-based integration

Cloud servers were another big technological shift over the last decade. The migration from on-premises servers to the cloud meant that software was available from remote locations. These changes represented a golden age in accounts payable automation software, with several SaaS accounting tools helping businesses connect data sources, mobiles, and even ERP tools to get a real-time, always up-to-date view of the business.

As teams adopted software that could automate many of the mundane tasks, such as AP invoice automation, they developed a thirst for freeing themselves from repetitive jobs. These tools’ flexibility, ease of use, scalability, and openness to integration have furthered the charge toward RPA.

#3. The rise of AI

The rise in capability and availability of AI tools in RPA is good news for firms who want to automate payables and other accounting activities. RPA facilitates efficient and accurate process automation already, but when augmented with Cognitive AI tools, such as Intelligent Document Processing or Generative AI, the scope of the technology grows quickly.

The previous era of RPA tools allowed teams to automate high-volume, repetitive, manual processes. This current era will allow for ML-driven decision-making, sophisticated data handling, intelligent invoice routing, and deeply integrated workflows and task allocation.

#4. Supply chain management

From COVID-19 to rampant inflation to the Suez Canal and Energy crises, supply chains have rarely been out of the news in recent years. Managing supply chains and fostering strong vendor relations is a growing theme.

Automation of accounts payable means that businesses can onboard suppliers, process invoices, and send payments quickly and accurately. Early payment discounts and forging closer relationships mean RPA can effectively pay for itself.

Benefits of AP automation

Accounting RPA opens up businesses and finance departments to a huge range of benefits. Here are some of the most compelling reasons why RPA is a mainstay in the accounting world.

#1. Accuracy

AP invoice automation is known for its high levels of accuracy. When performed manually, invoice payments can be duplicated, over or underpaid, and even forgotten about or sent to the wrong account. While these situations aren’t necessarily very common, when they do occur, they lead to problems that can harm vendor relationships.

#2. Efficiency

Invoice processing automation is about productivity and efficiency. Manual payments are time-consuming and require a lot of data entry, information verification, and approvals. Accounting RPA tools allow teams to outsource these repetitive tasks to a digital workforce and free up work hours. The net result is that human workers can work on strategies and build client relationships or pivot to other important tasks.

#3. Speed

Average invoice processing time is an essential metric for any accounts department. According to the 2022 Ardent Partners State of ePayables report, the average invoice processing time in the US was almost 11 days. The consequences of long processing time can be cash flow problems for suppliers and even an erosion of trust.

Robotic accounting allows teams to capture invoices, extract data, and automate approval workflows. Strong vendor relationships are essential, and quick invoice payments are something that any business appreciates.

#4. Lower costs

Late payment penalties add unnecessary costs to your budget that can hamper your profitability. What’s more, manual AP processing means labor costs. When you automate payable processes, you can ensure you pay in full and on time while saving money on staff. If you need to cut costs, that’s a good place to start.

#5. Regulatory compliance

Keeping your accounts compliant is a big job. Vendor payments are subject to regulations and reporting requirements related to taxes and transactions. Keeping a record of these processes is essential for audits, reports, and an overview of your business. RPA tools ensure the smooth running of your finances, and the best thing is that you always have a record of each transaction.

#6. Data-driven insights

The RPA process produces data that you can feed into your business intelligence or analytics tools. Crunching this information can create visibility into your AP operations and highlight spending patterns, vendor data, and any inefficiencies. Understanding this data helps teams adjust strategies, make forecasts, and make data-driven decisions. As ML tools have become democratized in recent years, even SMEs have access to powerful insights that can optimize their operations.

#7. Scalability

Seasonal companies are not the only ventures that experience the ups and downs of business. New opportunities, macroeconomic conditions, and shifts in consumer demand can cause increased or decreased purchasing. If workloads go up, more work hours must be invested in the AP process; if they go down, you are paying for AP staff that are sitting idle. RPA brings scalability to the AP process that grows or shrinks with you and ensures you are responsive to business needs at all times.

#8. Reduce fraud

The Association of Certified Fraud Examiners (ACFE) 2022 Global Fraud Study suggests that the average business loses over $150,000 per year due to accounts payable fraud. Indeed, it’s just behind asset misappropriation in terms of AP crime. RPA automation can slash these expenses by implementing controls and removing humans from the equation.

#9. Boost job satisfaction

According to a 2022 survey by the Institute of Finance and Management (IOFM), only 1 in 3 account payable professionals are very satisfied with their position. What’s more, per this study, the presence of accounting RPA is a major predictor of job satisfaction among accounting professionals. Reducing manual tasks lets your staff take on tasks that meaningfully connect with company goals and help improve job satisfaction.

#10. Better supplier relationships

In the research paper, The impact of relationship management on manufacturer resilience in emergencies (Yang, 2022), the authors note that during COVID-19, strong relationships between buyers and vendors resulted in more resilient supply chains. As such, the benefits of strong supplier relationships go beyond happier vendors and can affect the strength of your own business operations.

Use cases of Robotic Process

Automation in Accounting

RPA software has several powerful use cases in the accounts payable space. Here are some of the tasks that you can automate to reduce costs while driving productivity.

Invoice processing

Invoice automation is one of the most attractive use cases of RPA in the AP department. Teams can implement automation across the entire invoice processing lifecycle by extracting data from invoices (both paper and digital), matching them against purchase orders, requesting approval, and authorizing payments.

Data entry

AP systems require a considerable amount of data entry. A manual process is laborious and prone to human error. RPA automates data entry to these systems, and thanks to Intelligent Document Processing (IDP), this automation technology can read unstructured invoices, receipts, and a variety of other documents.

Vendor management

Good vendor management contributes to well-functioning supply chains and better products. However, there is a lot of manual work required to keep things running smoothly. RPA can help with automating onboarding, communication, maintenance, and payments.

Vendor deductions

Vendor deductions are part and parcel of the supply chain. Late deliveries, invoice errors, contractual violations, product quality issues, and SLA failures are just some of the situations that can lead to payment deductions. RPA tools can automate the communication of these problems and the processing of deductions, ensuring business loss is minimized and visible.

Expense management

Employee expense reports help keep track of traveling, food, and other work-related expenses. RPA tools can read and analyze receipts, upload them to company systems, and even verify and approve expenses against company policy. What’s more, you can also use RPA to reimburse staff members by automating transactions.

Report generation

RPA tools are adept at generating reports on AP performance. With the addition of business intelligence or ML tools, teams can perform highly sophisticated analysis on AP and improve and optimize their processes.

Compliance

RPA helps with internal controls and regulatory compliance by managing vendor applications and licensing and tracking invoice approvals and payments. This data is essential for general financial reporting or in the event of an audit.

Fraud detection

RPA can monitor and analyze AP data and identify inconsistencies and anomalies that suggest fraud. When paired with ML, teams can gain deep insights into vendors and ensure that everything is above board. Additionally, RPA tools can send real-time alert detection to ensure swift investigations and resolutions.

Price checking

While RPA can automate payable invoices, teams can also use the technology to check prices against other vendors to ensure they are getting value. Screen scraping tech can monitor websites at set intervals and provide crucial data that can save on expenses.

Onboarding

As we mentioned above, RPA helps with vendor onboarding. However, it can also support employee onboarding within the AP department. This process includes sending documentation and training materials, links to digital adoption platform (DAP) content, or links to company processes.

RPA for accounting case studies

RPA provides many use cases, including both automated accounts receivable and payables. However, to get a true appreciation of how accounts payable automation impacts a business, we need to explore some case studies. Here are three of the best.

AP automation use case #1

A UK-based FTSE 50 BPO and professional services company with annual revenues in excess of $2.5 billion had a highly inefficient purchase-to-pay process. Inputting data was performed manually by around 40 staff members around the country. Errors were frequent, and the process was painstakingly slow, leading to extended approval cycles and frequent queries from vendors.

The cost per invoice processed was around £8, and thanks to a reliance on paper invoices, the business earned an unwanted reputation for late payments. The company implemented an Enterprise Resource Planning (ERP) solution and sought to automate its account payable process.

The business centralized its payment processing data and implemented an Optical Character Recognition (OCR) solution to read paper invoices and convert the information into data. From there, RPA tools could sort, classify, and route invoices for approval.

The impact was significant. Invoice processing was slashed by 75%, down to £2 per invoice. Back-office staff were halved and moved off-site, saving £1m each year while allowing the business to process over 400,000 invoices each year.

AP automation use case #2

A well-known consumer goods company received around 10k invoices from 400 global customers each year. Each customer used its own invoice format, which meant processing each bill was time-consuming and subject to human error. The business wanted to streamline this process to save time and money and improve vendor relationships.

They chose an AP automation company that provides a mix of BPM, RPA, and AI technologies to help with the task. The plan was an end-to-end AP process that could take these diverse invoices and standardize the data, allowing for swift payments, approvals, and vendor oversight.

OCR was implemented to read the invoices, with RPA used to check the data against business rules and push it to the ERP system for validation. What’s more, RPA bots were used to build data-rich dashboards to detect PO and invoice exceptions and provide real-time notifications.

The results were spectacular, including a 90% reduction in effort and process turnaround time, plus cost savings of 50%.

AP automation use case #3

A prominent multinational manufacturer processed over 80,000 vendor invoices each year. With multiple screens and systems, manual data entry was time-consuming, complex, and error-prone.

The business looked for an accounts payable automation company with RPA features that could automate the process. However, there were some complexities to overcome. For starters, all invoices needed to be checked against the businesses’ ERP solution. Validating invoices had to be done against three different systems, with manual workers extracting the information.

The organization built an RPA solution to validate invoices against unique IDs. They both downloaded invoices, validated details, and updated them against a cloud-based web application. Invoice processing time was cut by 50% while transaction accuracy shot up to a perfect 100%.

Challenges of Accounts Payable

Automation Implementation

While the benefits of AP automation should now be clear, there are also some challenges that teams must contend with to unlock the power of RPA within accounts payable. Here are some areas to keep an eye on.

#1. Costs

Implementing an RPA solution for accounts payable comes with some costs. As businesses around the world look to reduce operating costs to stay competitive in a difficult financial environment, budgets are under pressure.

Return on investment (ROI) is a crucial part of convincing the C-Suite to invest in account payable RPA solutions. However, as you can see from our case studies in this article, implementing a solution with payables or receivables automation can pay for itself quickly.

For businesses that lack the internal expertise to implement RPA software and are worried about training costs, ZAPTEST Enterprise comes with a dedicated ZAP Expert who can assist with the design and implementation of your AP automation and help accounting staff get up to speed.

#2. Data integration

Accounting departments use a broad mix of software. Some have up-to-the-minute ERP tools, while others are languishing away with legacy software. Systems can be highly incompatible because of different data standards, formats, and structures. Ensuring these tools can communicate together can be complex and require a high level of customization.

Thankfully, RPA tools are more than up to the task due to IDP, OCR, screen scraping, and other tech.

#3. Data security

Security is another important consideration because AP processing deals with financial information. Fraud, data breaches, and unauthorized access are paramount, and any system must be designed with safeguards in place. Additionally, GDPR and even KYC and AML regulations mean that holding customer data and ensuring vendors are legit are other things to keep in mind.

#4. Change management

Moving from manual AP processing to automated systems requires upheaval and a considerable rethink of workflows. What’s more, it can also involve specific roles or individuals becoming redundant in the business.

Successful change management involves transparency and clear communication of not just how the new technology will work but what benefits it will bring. Additionally, retraining or upskilling employees can go a long way toward overcoming tension about the software.

#5. Vendor resistance

It’s not just your employees who can become stuck in their ways. Implementing an automated AP system can also inconvenience vendors who are hesitant to alter their invoice submission process. The best thing to do here is to explain how faster invoice processing will benefit the vendor directly and even offer support or training to their staff so they can get on board. With cloud-based RPA tools now commonplace, creating a portal that vendors can access has never been easier.

Trends in RPA for accounting

RPA tools for both automated accounts receivable and payables are improving in response to shifting requirements and technological innovations. Let’s explore some of the biggest trends for AP automation from 2024.

1. More AI

AI and ML have been the big story of 2023, and 2024. These tools, when used to augment RPA systems, can help with invoice processing, fraud detection, and even exception handling. Perhaps the most interesting part is the use of Cognitive AI tools that can learn from data and even make optimal decisions based on historical data.

Advances in AP exception handling are particularly impressive. While RPA bots can handle most tasks when augmented with AI, these processes can adjust and adapt to invoices with missing or incomplete data, deal with disputed invoices, or flag payments that need manual intervention.

2. Supplier onboarding

Supplier onboarding has become more complex in recent years. In part, that has to do with the mitigation of risk, but other factors include increased use of ERP systems and a broader trend toward digitization. RPA tools help with onboarding by automating the process, making it quicker and easier for all parties. A big trend in 2023 has been removing supply chain bottlenecks, and simpler onboarding is a big part of that.

3. Embracing early payment programs

Everyone is trying to cut costs right now. While RPA tools help with this process in several different ways, some of the best AP automation savings come from taking full advantage of early payment programs. RPA lets AP teams speed up the validation, approval, and issuance of invoices, improving vendor cash flow while knocking a few percent off their expense. For businesses with lots of suppliers, the savings can be significant.

4. Data security

Data security is rarely out of the news, and 2023 has been no different. Storing and transmitting sensitive financial data is a concern that every business needs to take seriously. Any leaks can prove catastrophic to reputation and lead to big fines. RPA tools have many cybersecurity benefits, including providing access controls for AP data and security via encryption or APIs.

5. Managed RPA

Managed RPA services designed for payable and receivables automation are quickly emerging. There are several factors at play here, including limited in-house access to RPA skills plus the benefits of RPAaaS software that make planning, implementation, and maintenance of AP RPA software quicker and more cost-effective.

What’s more, Managed RPA services for account payables provide a predictable monthly or annual charge, which suits a lot of teams.

The future of AP automation

Thanks to RPA with AI capabilities, AP automation already seems pretty futuristic. However, the technology will not stop there. Here are some insights into AP automation and RPA market size as the decade advances.

1. Hyperautomation

Automation software in every industry is leading toward hyperautomation. With RPA and AI tools of sufficient quality, entire accounting teams could be automated, leading to lightning-quick payments supported by predictive analytics.

2. Custom accounting software

Generative AI, no-code tools, and coding co-pilots all represent the future of AP software automation. While there will still be room for off-the-shelf software, accounting teams will be able to build customized tools to help automate their daily tasks.

Applications will be capable of meeting even the most marginal use cases, workflows, and business cultures, leading to personalized tools capable of impressive productivity. RPA tools like ZAPTEST pair automation with test automation software, allowing teams to build high-quality, robust, and secure custom tools.

3. Embedded payments

AP software with embedded payments will be one of the most interesting software developments of the future. Instead of sending transactions to payment processors, accounting teams (or bots) will trigger instant electronic payment from within the app, across borders and financial zones.

4. Next level analytics

As digitization of the AP automation process continues to produce data, analytics tools will find underlying patterns in this information and produce deep insights into cash flow, spending patterns, and vendors. These advances will revolutionize AP and lead to less risk and more optimization.

Final thoughts

RPA for accounting is becoming essential for teams who want to benefit from great vendor relationships and smooth supply chains. With so many manual and repetitive processes to mechanize, AI-assisted RPA can help create scalable, flexible, and streamlined solutions for accounting departments of every kind.

Accounts payable automation is an elegant solution for teams who want to automate payables, save money, become more efficient, and get great insights into their financial performance. Add in fraud detection and assistance with regulatory compliance, and it’s easy to see why RPA is taking over the accounting space.